December 11, 2023

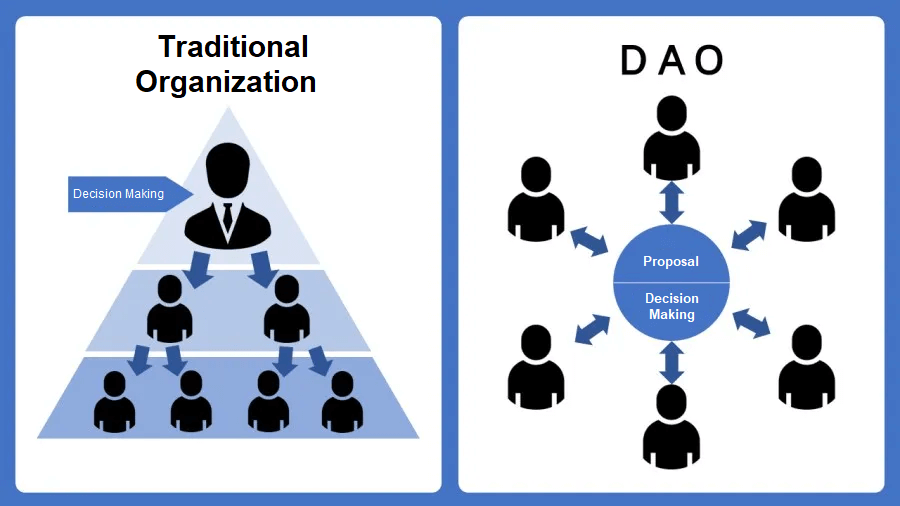

News for Decentralised Autonomous Organisations (DAOs)

Yesterday, the ADGM released the Distributed Ledger Technology Foundations Regulations 2023 (DLT Regulations), which provide a legal framework for distributed ledger technology (DLT) or DAO foundations.

A DLT foundation is a legal entity that can hold and manage digital assets for a specified purpose, such as supporting a DLT network or protocol.

Registering a DLT Foundation

To register a DLT foundation, the founder must submit a charter and other documents to the Registrar of DLT Foundations, and pay a fee. The charter must specify the objects, activities, governance, and beneficiaries of the DLT foundation, as well as the rights and obligations of the tokenholders. Tokenholders are persons who hold or control tokens issued by the DLT foundation, and who have certain voting and information rights.

A DLT foundation must have a minimum initial asset value of $50,000 USD and may receive additional endowments from the founder or other sources. The assets of the DLT foundation are separate from those of the founder, the councilors, the guardian, and the beneficiaries, and are not subject to foreign laws that may affect their ownership or transfer.

Governance requirements

The governance of a DLT foundation is conducted by:

(a) Council: Responsible for managing the assets and affairs of the DLT foundation in accordance with the charter and the DLT Regulations. The council must have at least two councillors, who are subject to certain qualifications and duties.

(b) Guardian: Appointed by the founder or the council and has the role of ensuring that the council acts in accordance with the objects of the DLT foundation. The guardian also has certain powers and duties and may be removed or replaced by the council or the token holders.

(c) Token holders: May approve or reject matters affecting the DLT foundation, such as amendments to the charter, migration, or dissolution, by passing qualified or ordinary resolutions.

Reporting obligations

A DLT foundation must keep accounting records and prepare annual accounts, audited by an independent auditor. The accounts must be published on the DLT foundation’s website and filed with the Registrar within six months of the end of the financial year. The Registrar has the power to review, revise, or order the correction of the accounts, and to impose fines for non-compliance.

Conclusion

The DLT Regulations are the first formal framework for DAOs. In the recent past, DAO frameworks in Wyoming and Marshall Islands gained some traction, but were not as popular given the lack of regulatory clarity in the relevant jurisdictions surrounding DAO activities.

The DLT Regulations have been introduced in the ADGM which has already put in place, since 2018, a robust framework to regulate digital assets and their service providers. A study of each DAO and its activities is essential to understand the regulations applicable to their activities in the ADGM.