December 9, 2024

We Can DAO It! Navigating Legal Challenges and Solutions for Decentralised Autonomous Organisations

KEY TAKEAWAYS

- The Andrew Samuels v. Lido DAOcase highlights the risk of DAO participants being held personally liable under state partnership laws.

- Unincorporated DAOs are exposed to unlimited liability and lack legal entity protections, complicating regulatory compliance.

- Incorporated DAOs usually provide legal protections and structured governance frameworks.

- ADGM and RAK DAO offer tailored solutions for DAO incorporation, supporting decentralised operations within a legal framework.

- The ruling could signal a global trend towards stricter DAO accountability, challenging their decentralised ethos.

INTRODUCTION

In a recent ruling of Andrew Samuels v. Lido DAO,[i] the United States District Court for the Northern District of California (“Court“) addressed the legal complexities surrounding decentralised autonomous organisations (“DAO“). The Court declined to dismiss allegations against Lido DAO,[ii] a leading Ethereum-based staking protocol, finding that the governing body behind the DAO could potentially be classified as a general partnership under California law. While not yet conclusively resolved through the decision, this interpretation highlights the risks DAO participants may face, even in decentralised frameworks.

This decision is pivotal in the evolving relationship between decentralised governance structures and traditional legal frameworks. While the ruling underscores the risks associated with unincorporated DAOs, it raises critical questions: Does this mark the beginning of stricter accountability for DAOs? Could global jurisdictions adopt similar approaches, or will frameworks emerge to legitimise DAOs without stifling innovation?

UNDERSTANDING THE CASE

The case stemmed from a lawsuit filed by investor Andrew Samuels, who claimed to have suffered financial losses after purchasing Lido tokens during its initial coin offering. Andrew Samuels alleged that Lido DAO violated securities regulations by failing to register its tokens with the United States Securities and Exchange Commission, thus violating federal securities laws.

Lido DAO’s defence centred around its decentralised nature, arguing that this should exempt it from traditional legal obligations. However, the Court rejected this argument, ruling that Lido DAO’s members could still be liable under state partnership laws. In particular, major institutional investors—including Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management—were specifically named as general partners due to their significant roles in Lido’s governance and decision-making processes.

The ruling highlighted a crucial point: even minimal participation in a DAO’s governance could expose its members to liability under established legal frameworks. This decision reminds us that DAOs may not be as immune from traditional legal scrutiny as they may appear in spirit.

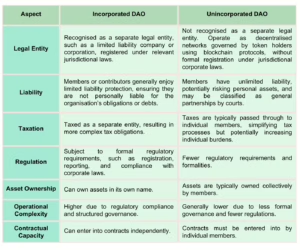

UNINCORPORATED DAOs VS INCORPORATED DAOs: A COMPARATIVE ANALYSIS

UAE’S UNIQUE SOLUTIONS FOR INCORPORATED DAOs

Given the numerous issues now coming to light regarding using unincorporated DAOs for Web3 operations and needs, an incorporated DAO is the need of the hour.

The United Arab Emirates (“UAE”) has positioned itself as a leader in providing clear frameworks for DAOs. Two free zones in the UAE have formulated bespoke frameworks for DAOs, offering tailored solutions to meet their specific needs.

Abu Dhabi Global Market: In 2023, the Abu Dhabi Global Market (“ADGM“) introduced a Digital Ledger Technology (“DLT“) Foundations regime designed to provide a legal framework for DAOs. Under this regime, DAOs are registered as foundations within ADGM, allowing them to operate as separate legal entities. These entities can use, deploy, develop, facilitate, or support DLT applications and token issuance within ADGM.[iii]

Additionally, the legal structure of an ADGM DLT Foundation enables it to hold and manage virtual assets in support of decentralised protocols. Importantly, this framework ensures that the foundation members are immune from liability, providing protection to individuals involved in DAOs. At the same time, it incorporates an organisational and governance structure that supports the decentralised decision-making model inherent to DAOs, ensuring that governance remains in line with their intended autonomy.[iv]

Ras Al Khaimah Digital Asset Oasis: The Ras Al Khaimah Digital Asset Oasis (“RAK DAO”) introduced a DAO Association Regime, which takes the legal form of a body corporate with a separate legal personality from its members and token-holders.[v] Within the RAK DAO ecosystem, designed to foster virtual asset activities, the DAO Association operates as a legal structure with various categories of members whose liability is limited by guarantee.[vi] The DAO Association is authorised to undertake token issuance and other business activities, provided they are not legally restricted.[vii]

Treatment of Security Tokens: ADGM vs. RAK DAO: A key difference between the ADGM and the RAK DAO is their treatment of security tokens. Under the RAK DAO framework, issuers of security tokens are not eligible to constitute a DAO Association, as the jurisdiction of the Securities and Commodities Authority (“SCA”) would apply to such issuances.[viii] Therefore, permission from the SCA would be required to offer virtual assets classified as securities. In contrast, the ADGM’s regulatory framework allows for offering digital securities, subject to the relevant regulations, providing more certainty.[ix]

CONCLUSION

The ruling in Andrew Samuels v. Lido DAO highlights the tension between the decentralised nature of DAOs and the traditional legal framework. The lack of legal recognition for unincorporated DAOs exposes their members to significant risks, while conventional legal structures struggle to accommodate the innovative aspects of decentralised governance. Tailored frameworks, such as those offered by the ADGM and RAK DAO, provide proactive options to address these challenges, ensuring that the potential of DAOs is preserved without sacrificing innovation due to legislative inertia or convenience.

***

TLP Advisors is a dynamic and forward-thinking consulting, strategy and law firm specialising in providing cutting-edge solutions to our diverse clientele. With our roots deeply embedded in financial services, gaming, web3, and emerging tech, we offer unparalleled knowledge and support tailored to these rapidly evolving sectors’ unique challenges and opportunities.

TLP Advisors has consistently been the firm of choice for L1 chains, DeFi protocols, gaming companies, fintech and payment companies, foundations, funds, and investors. We have built a reputation for excellence through frequent collaborations with regulators, funds, and technology incubators. Our deep understanding of the intricate regulatory landscapes and industry dynamics allows us to provide strategic guidance and innovative solutions that empower our clients to navigate complex challenges and seize emerging opportunities.

***

[i] Andrew Samuels v. Lido Dao, Case No. 23-cv-06492-VC, https://fingfx.thomsonreuters.com/gfx/legaldocs/zdpxqkyedvx/frankel-lidoDAO–MTDopinon.pdf.

[ii] Lido, https://lido.fi.

[iii] Section 3 of the ADGM’s Distributed Ledger Technology Foundations Regulations 2023.

[iv] Section 27(1) of the ADGM’s Distributed Ledger Technology Foundations Regulations 2023.

[v] Section 8 of the RAK DAO’s DAO Association Regulations.

[vi] Sections 36 and 37 of the RAK DAO’s DAO Association Regulations

[vii] Sections 10 and 11 of the RAK DAO’s DAO Association Regulations

[viii] Token issuance within the RAK DAO requires a legal opinion that the token does not constitute a security token for the purpose of the UAE federal law, as per Section 10 of the RAK DAO’s DAO Association Regulations

[ix] ADGM’s Guidance on Regulation of Digital Security Offerings and Virtual Assets under the Financial Services and Markets Regulations.