November 7, 2024

Trumping the Crypto Landscape: Could a Second Term Reshape the Future of Crypto in the US?

KEY TAKEAWAYS

- The crypto market reacted positively to Donald Trump’s election win, with Bitcoin rising to $75,000 due to anticipated pro-crypto policies.

- Despite previously being critical of crypto, Trump has embraced it, aiming to make the US a global crypto hub.

- A Trump-driven administration could spark a regulatory shift globally, encouraging other jurisdictions to adopt more flexible crypto regulations.

- The industry anticipates the emergence of a more crypto-friendly SEC.

INTRODUCTION

The crypto world is reacting strongly to Donald Trump’s victory. Bitcoin surged by 7% to reach a record $75,000, signalling clear market optimism about the potential policies of the Trump administration’s second term.[i]

With Trump’s promises to end what he calls the “persecution” of the crypto sector and his pledge to make the United States (“US“) a “bitcoin and cryptocurrency capital,” traders and investors are eager to see if a new era for digital assets is on the horizon.[ii] Although Trump was previously sceptical about cryptocurrencies, branding them a “scam,” he now envisions making the US the “bitcoin and cryptocurrency capital of the world.”

FUTURE PREDICTIONS: A NEW ERA FOR CRYPTO?

Policy Promises

Trump has promised several policy initiatives designed to support the crypto industry, including his intention to remove regulatory hurdles and excessive that have stifled growth and investment in the sector. Trump’s statements suggest that a second term could see sweeping policy changes to foster a more permissive environment for digital assets, opening new growth opportunities.

The role of the launch of World Liberty Financial

In a landmark move, Trump recently announced that he, his sons, and various entrepreneurs have launched a digital currency platform named World Liberty Financial – a decentralised finance protocol.[iii] With this, Trump has positioned himself as a proponent of the crypto industry and an active participant in its development.

If Trump’s promises translate into concrete policy changes, the US could take a leading role in the global crypto market. A shift in US policy could have significant ripple effects across international markets, including in the UAE.

A Regulatory Domino Effect

The US has historically been a trendsetter in financial regulation, and a Trump-led, crypto-friendly policy shift could influence other regions. Jurisdictions like the European Union, which have traditionally adopted a cautious regulatory stance, may reconsider their approach to remain competitive.

Such a shift could ignite a regulatory domino effect, encouraging even conservative markets to adopt more flexible policies towards digital assets.

Potential reorganisation of the SEC leadership

The SEC has focused heavily on enforcement, imposing over $426 million in litigation costs on crypto firms in recent years.[iv]

During his recent campaign, Trump proposed reorganising the leadership at the SEC, citing their tough stance against crypto companies as a key reason.[v] This would be challenging without formal cause, this statement hints at a potential move towards a more accommodating regulatory stance under Trump’s administration.

This shift could lead to more defined regulatory frameworks for digital assets, focusing on encouraging innovation within compliance rather than punitive measures.

De-Fi Boom and Stablecoin regulations

Given Trump’s statements and active involvement with World Liberty Financial, expectations are high for a more lenient approach from the SEC toward the decentralized finance sector. Reflecting this optimism, $AAVE, $UNI, and $ENA each surged by over 20% on election day. Further, as Caroline Pham, Commissioner at the Commodity Futures Trading Commission, highlighted, the US will now prioritise stablecoin regulations and provide regulatory certainty to inspire investor confidence.xiii

UAE’S FORWARD-THINKING APPROACH TO CRYPTO REGULATION

The United Arab Emirates (“UAE“) has positioned itself as a leader in crypto regulation, with progressive frameworks that have attracted global attention. For instance, the Central Bank of the UAE has introduced regulations for payment tokens backed by the Emirati Dirham,[vi] and the Securities and Commodities Authority has issued guidelines for virtual assets and virtual asset service providers.[vii]

In addition to these national regulations, the Virtual Assets Regulatory Authority in Dubai has implemented a comprehensive set of rules tailored specifically to virtual assets, creating a robust regulatory environment for crypto businesses operating within the emirate. The Abu Dhabi Global Market also provides a distinct regulatory framework, offering a supportive environment for crypto firms with clear policies designed to protect investors while encouraging innovation.

Pro-Crypto Stance of UAE Authorities

UAE authorities have consistently shown a pro-crypto outlook, aiming to foster a balanced environment that supports innovation while maintaining high regulatory standards. The UAE’s focus on positioning itself as a global blockchain and crypto hub has attracted numerous crypto exchanges and blockchain firms to establish a presence here.[viii]

Looking Ahead: Harmonisation between the US and the UAE

As the US re-evaluates its approach to crypto, greater regulatory harmonisation between the US and UAE could provide a stable global framework that benefits both markets and their investors. With the UAE’s established track record and robust regulatory environment, alignment with US regulations could open pathways for easier cross-border transactions, enhanced innovation, and broader market participation.

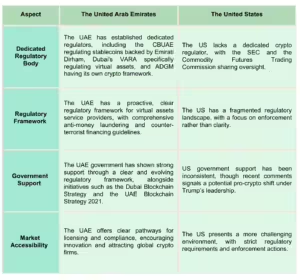

UAE vs. US: A Comparative Overview of Crypto Regulation

The following table compares the UAE’s and the US’s current regulatory statuses, highlighting key differences and developments in their approaches to cryptocurrency regulation.

CONCLUSION

Trump’s anticipated approach to potential regulatory leniency could mark a pivotal shift for the crypto landscape in the US. However, the path forward will depend on whether policy changes align with the sector’s expectations and how the SEC balances oversight with fostering a competitive crypto ecosystem. As the US crypto scene braces for potential change, all eyes will be on the administration’s actions in the coming months, shaping the future of decentralised finance on American soil and globally.

***

TLP Advisors is a dynamic and forward-thinking consulting, strategy and law firm specialising in providing cutting-edge solutions to our diverse clientele. With our roots deeply embedded in financial services, gaming, web3, and emerging tech, we offer unparalleled knowledge and support tailored to these rapidly evolving sectors’ unique challenges and opportunities.

TLP Advisors has consistently been the firm of choice for L1 chains, DeFi protocols, gaming companies, fintech and payment companies, foundations, funds, and investors. We have built a reputation for excellence through frequent collaborations with regulators, funds, and technology incubators. Our deep understanding of the intricate regulatory landscapes and industry dynamics allows us to provide strategic guidance and innovative solutions that empower our clients to navigate complex challenges and seize emerging opportunities.

***

[i] Agence France-Presse, Bitcoin reaches record high of $75,000 as traders bet on Trump victory (06 November 2024), https://www.theguardian.com/technology/2024/nov/06/bitcoin-reaches-record-high-of-75000-as-traders-bet-on-trump-victory.

[ii] Kimberlee Kruesi, Trump calls for US to be ‘crypto capital of the planet’ in appeal to Nashville bitcoin conference, AP News (28 July 2024), https://apnews.com/article/donald-trump-bitcoin-cryptocurrency-stockpile-6f1314f5e99bbf47cc3ee6fc6178588d.

[iii] David Yaffe Bellany, et. al., Trump Rolls Out His New Cryptocurrency Business, The New York Times (16 September 2024), https://www.nytimes.com/2024/09/16/technology/trump-crypto-world-liberty-financial.html.

[iv] Tracking the SEC’s Anti-Crypto Crusade, Regulation by Enforcement, Blockchain Association (01 November 2024), https://theblockchainassociation.org/regulation-by-enforcement/.

[v] MacKenzie Sigalos, Here’s what Trump promised the crypto industry ahead of the election, CNBC (06 November 2024), https://www.cnbc.com/2024/11/06/trump-claims-presidential-win-here-is-what-he-promised-the-crypto-industry-ahead-of-the-election.html.

[vi] Soham Jethani, et.al., Securing Digital Finance: An Overview of the UAE’s Payment Token Services Regulation, TLP Advisors (08 July 2024), https://techlawpolicy.com/2024/07/securing-digital-finance-an-overview-of-the-uaes-payment-token-services-regulation/

[vii] Soham Jethani, et.al., SCAnning VASPs: Guidelines for Regulation of Virtual Assets and Virtual Asset Service Providers, TLP Advisors (08 August 2024), https://techlawpolicy.com/2024/08/scanning-vasps-guidelines-for-regulation-of-virtual-assets-and-virtual-asset-service-providers/

[viii] Soham Jethani and Pankhuri Malhotra, UAE: A Crypto Asset Hub, TLP Advisors (01 January 2023), https://techlawpolicy.com/2023/01/uae-a-crypto-asset-hub/