December 26, 2024

A New Block in the Chain: Exploring ADGM’s Transformative Consultation Paper

KEY TAKEAWAYS

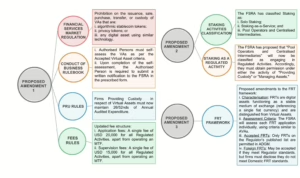

- The Abu Dhabi Global Market (ADGM) introduced Consultation Paper 11 of 2024, proposing significant amendments to its Virtual Assets framework to address risks and promote growth.

- New prohibitions include algorithmic stablecoins, privacy tokens, and similar technologies. The Financial Services Regulatory Authority (FSRA) can now halt certain Virtual Asset activities if they contravene regulations or ADGM’s interests.

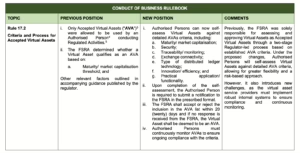

- Authorised Persons can self-assess Virtual Assets against detailed criteria, including maturity, security, traceability, and innovation. Notifications must be submitted to FSRA, which will accept or reject within 20 days.

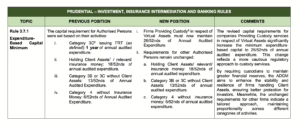

- Firms providing custody for Virtual Assets must maintain higher capital reserves (26/52nds of annual audited expenditure), enhancing stability and investor protection.

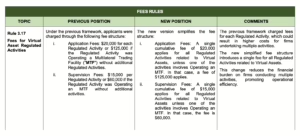

- A unified application and supervision fee structure reduces costs for firms conducting multiple Virtual Asset activities, promoting operational efficiency.

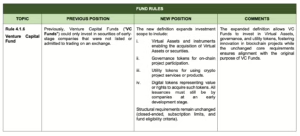

- VC Funds can now invest in Virtual Assets, governance tokens, and utility tokens, fostering blockchain innovation while adhering to early-stage investment criteria.

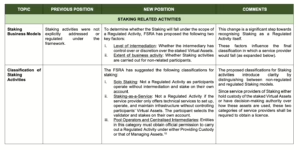

- Proposed classifications distinguish between regulated and non-regulated staking models. Pool operators and intermediaries must obtain licences for custody or asset management services.

- FRTs are defined as stable digital assets tied to fiat currency. The FSRA will distinguish FRTs from Virtual Assets and assess foreign FRTs against domestic standards.

- ADGM’s proposed amendments aim to enhance transparency, safety, and compliance while fostering innovation in Virtual Asset markets.

INTRODUCTION

Regulations related to Virtual Assets[1] are undergoing seismic changes worldwide to address risks and promote growth. The Abu Dhabi Global Market (“ADGM“) opened comments for Consultation Paper 11 of 2024[2] and has proposed pivotal amendments to its existing framework for Virtual Assets.

SUMMARY OF THE PROPOSED AMENDMENTS

PROPOSED AMENDMENT 1: SUGGESTED AMENDMENTS TO THE VIRTUAL ASSETS FRAMEWORK

Below, we have analysed all the proposed changes and outlined their implications:

PROPOSED AMENDMENT 2: SUGGESTED AMENDMENTS FOR STAKING AS A REGULATED ACTIVITY

PROPOSED AMENDMENT 2: SUGGESTED AMENDMENTS FOR STAKING AS A REGULATED ACTIVITY

Below is an overview of the changes proposed for the Staking.[9]

PROPOSED AMENDMENT 3: SUGGESTED AMENDMENTS FOR THE FRT REGIME

We have previously analysed the changes introduced to the FRT regime through Consultation Paper No. 7 of 2024.[11] In the table below, we aim to analyse the changes brought through Consultation Paper No. 11 of 2024. The proposed updates to the fiat-referenced tokens (“FRTs“) regime introduce clearer distinctions and stricter requirements to align with the Regulator’s standards. Key changes include:

HOW TLP ADVISORS CAN ASSIST?

At TLP Advisors, we are a forward-thinking consulting, strategy, and law firm specialising in solutions for the financial services, gaming, Web3, and emerging tech sectors. With deep expertise in these industries, we provide tailored support to address their unique challenges.

Our team has extensive experience providing advisory support to clients navigating the ADGM framework. From assisting with company incorporation within ADGM to guiding businesses through its complex regulatory landscape and licensing, we offer comprehensive services to ensure our clients achieve compliance and success in this dynamic environment.

CONCLUSION

The proposed changes to ADGM’s Virtual Asset framework reflect a forward-thinking approach that balances innovation with regulatory vigilance. By addressing emerging risks, streamlining processes, and introducing clear guidelines for activities like Staking and Virtual Asset custody, ADGM aims to create a secure and dynamic environment for market participants. These amendments enhance compliance standards and open up new opportunities for businesses and investors within the evolving digital asset landscape.

***

TLP Advisors is a dynamic and forward-thinking consulting, strategy and law firm specialising in providing cutting-edge solutions to our diverse clientele. With our roots deeply embedded in financial services, gaming, web3, and emerging tech, we offer unparalleled knowledge and support tailored to these rapidly evolving sectors’ unique challenges and opportunities.

TLP Advisors has consistently been the firm of choice for L1 chains, DeFi protocols, gaming companies, fintech and payment companies, foundations, funds, and investors. We have built a reputation for excellence through frequent collaborations with regulators, funds, and technology incubators. Our deep understanding of the intricate regulatory landscapes and industry dynamics allows us to provide strategic guidance and innovative solutions that empower our clients to navigate complex challenges and seize emerging opportunities.

www.techlawpolicy.com

***

[1] Virtual Assets refers a digital form of value that can be traded online and serves as a medium of exchange, a unit of account, or a store of value. Virtual assets are distinct from fiat currency and electronic money.

[2] Consultation Paper No. 11 of 2024, Proposed Amendments to the Digital Asset Regulatory Framework, The Financial Services Regulatory Authority, ADGM (05 December 2024), https://assets.adgm.com/download/assets/Consultation+Paper+No.+11+of+2024+-+Proposed+Amendments+to+the+Digital+Asset+Regulatory+Framework.pdf/3acc8760b2f411ef8da15eec0cc5c1b0.

[3] Accepted Virtual Asset means a Virtual Asset that, in the opinion of the Regulator, meets the requirements for an Authorised Person conducting a Regulated Activity in relation to Virtual Assets.

[4] Any individual who was the financial services permission by the FSRA to carry on one or more Regulated Activities.

[5] Regulated Activities refers to the following activities undertaken in relation to Virtual Assets: a) Dealing in Investments as Principal; b) Dealing in Investments as Agent; c) Advising on Investments or Credit; d) Arranging Deals in Investments; e) Managing Assets; f) Providing Custody; g) Arranging Custody; and h) Operating a Multilateral Trading Facility.

[6] An Authorised Person providing either of the following Regulated Activities: (i) Managing Assets; (ii) Managing a Collective Investment Fund; (iii) Providing Custody (where it does so other than for a Fund); (iv) Managing a Profit Sharing Investment Account which is a PSIAr; (v) Providing Trust Services (where it is acting as trustee in respect of at least one express trust); (vi) Providing Money Services; or (vii) Issuing a Fiat-Referenced Token.

[7] Client Asset means any money or investments that an authorised person holds or manages on behalf of a client as part of their business activities.

[8] Providing Custody means holding or safeguarding financial instruments, Virtual Assets, spot commodities, or fund property on behalf of others, including managing or administering those assets.

[9] Staking is a process by which users or participants of a blockchain network or protocol participate in a Proof-of-Stake consensus mechanism.

[10] Managing Assets means managing, on a discretionary basis, assets belonging to another person, including financial instruments, virtual assets, spot commodities, or rights under a contract of long-term insurance (excluding reinsurance).

[11] Please find our previous article on the initial consultation paper here.

[12] Please read more on this at: https://www.crypto-news-flash.com/tethers-usdt-gains-ava-status-in-abu-dhabis-financial-hub/

[13] Please find our previous article of the inclusion of FRT issuance as a Regulated Activity here.